Help Center

YU Bot Tutorials

How to Find and Analyze Successful Wallets on ETH, SOL, BSC, and BASE Networks.

Step by Step (english)

Tracking successful wallets in the cryptocurrency space involves identifying those that have made significant gains by purchasing tokens at low prices and selling them at high prices. Here’s a step-by-step guide on how to find and analyze such wallets on Ethereum (ETH), Binance Smart Chain (BSC), and BASE networks.

1. Understanding Successful Wallets

Successful wallets are those that have achieved substantial profits through strategic buying and selling. Indicators of success include:

- High Return on Investment (ROI): Wallets that have seen 10x, 100x, or even 1000x returns.

- Transaction History: Detailed records of transactions showing purchases at low prices and sales at high prices.

- Profit and Loss (PnL) Analysis: Clear documentation of profits and losses.

2. Tools and Websites for Tracking Wallets

Several platforms allow you to track and analyze the performance of wallets. Here are some of the most effective tools:

- DexCheck: This tool provides a wallet analyzer that lets you visualize the PnL and trading history of any submitted wallet address. It’s integrated across 30 DEXs and 21 chains, making it versatile for ETH, BSC, and BASE networks.

- Peachfolio: A comprehensive DeFi portfolio tracker that supports ETH, BSC, Solana, and Avalanche chains. It allows you to track multiple wallets, set price alerts, and analyze trades in-depth.

- CoinGecko: Offers wallet tracking and whale tracking features, providing insights into significant transactions and the movements of large holders.

- Zerion: Focused on Ethereum and DeFi, it provides a simple interface to track wallet history, investments, and more.

- Zapper: Supports multiple blockchains, including Ethereum, BSC, and Polygon, and provides a dashboard to track and manage DeFi assets.

- Ape Board: A cross-chain DeFi dashboard that supports Ethereum, BSC, Polygon, Terra, and Solana, offering detailed tracking of DeFi assets.

- Tin Network: Supports multiple blockchains and offers a simple interface to track DeFi assets, including Ethereum, BSC, Fantom, and more.

3. Steps to Analyze Wallets

- Identify the Wallet: Use tools like DexCheck or CoinGecko to find wallets that show significant transaction volumes or high profitability.

- Transaction History: Examine the transaction history for patterns of buying low and selling high. Look for early entries into successful tokens and timely exits.

- Profit and Loss Statements: Use tools like Peachfolio or Zerion to get detailed PnL reports. This helps in understanding the wallet’s overall profitability.

- Whale Tracking: Utilize whale tracking features on platforms like CoinGecko to follow the movements of large holders, often considered to be more informed investors.

- Price Alerts and Notifications: Set up price alerts on platforms like Zapper to stay informed about significant price movements that might indicate profitable trading opportunities.

4. Key Considerations

- Security: Ensure the platforms you use do not require private keys or seed phrases. Most tracking tools only need the public wallet address.

- Data Privacy: Choose platforms that respect your data privacy and do not track personal information.

- User Interface: Select tools with intuitive and user-friendly interfaces for easier navigation and analysis.

YUBot Video Tutorials (german)

Tutorials (german)

Step by Step (deutsch)

Das Finden erfolgreicher Wallets im Kryptowährungsbereich beinhaltet die Identifizierung derjenigen, die durch den Kauf von Token zu niedrigen Preisen und deren Verkauf zu hohen Preisen erhebliche Gewinne erzielt haben. Hier ist eine Schritt-für-Schritt-Anleitung, wie Du solche Wallets auf Ethereum (ETH), Binance Smart Chain (BSC) und BASE-Netzwerken finden und analysieren kannst.

1. Erfolgreiche Wallets verstehen

Erfolgreiche Wallets sind diejenigen, die durch strategische Käufe und Verkäufe erhebliche Gewinne erzielt haben. Zu den Erfolgsindikatoren gehören:

- Hoher Return on Investment (ROI): Wallets, die eine 10-, 100- oder sogar 1000-fache Rendite erzielt haben.

- Transaktionshistorie: Detaillierte Aufzeichnungen von Transaktionen, die Käufe zu niedrigen Preisen und Verkäufe zu hohen Preisen zeigen.

Gewinn- und Verlustanalyse (PnL): Klare Dokumentation von Gewinnen und Verlusten.

2. Tools und Websites zur Verfolgung von Wallets

Mehrere Plattformen ermöglichen es Dir, die Leistung von Wallets zu verfolgen und zu analysieren. Hier sind einige der effektivsten Tools:

- DexCheck: Dieses Tool bietet einen Wallet-Analysator, mit dem Du die PnL- und Handelshistorie jeder eingereichten Wallet-Adresse einsehen kannst. Es ist in 30 DEXs und 21 Chains integriert, was es vielseitig für ETH-, BSC- und BASE-Netzwerke macht. > DexCheck

- Peachfolio: Ein umfassender DeFi-Portfolio-Tracker, der ETH-, BSC-, Solana- und Avalanche-Ketten unterstützt. Es ermöglicht Dir, mehrere Wallets zu verfolgen, Preiswarnungen einzustellen und Trades eingehend zu analysieren. > Peachfolio

- CoinGecko: Bietet Wallet-Tracking- und Wal-Tracking-Funktionen, die Einblicke in wichtige Transaktionen und die Bewegungen großer Inhaber bieten. > CoinGecko

- Zerion: Konzentriert sich auf Ethereum und DeFi und bietet eine einfache Schnittstelle, um die Wallet-Historie, Investitionen und mehr zu verfolgen. > Zerion

- Zapper: Unterstützt mehrere Blockchains, einschließlich Ethereum, BSC und Polygon, und bietet ein Dashboard zur Verfolgung und Verwaltung von DeFi-Assets. > Zapper

- Ape Board: Ein kettenübergreifendes DeFi-Dashboard, das Ethereum, BSC, Polygon, Terra und Solana unterstützt und eine detaillierte Verfolgung von DeFi-Assets ermöglicht. > Ape Board

- Tin Netzwerk: Unterstützt mehrere Blockchains und bietet eine einfache Schnittstelle zur Verfolgung von DeFi-Assets, einschließlich Ethereum, BSC, Fantom und mehr. > Tin Network

3. Schritte zum Analysieren von Wallets

- Identifiziere die Wallet: Verwende Tools wie DexCheck oder CoinGecko, um Wallets zu finden, die ein hohes Transaktionsvolumen oder eine hohe Rentabilität aufweisen.

- Transaktionsverlauf: Untersuche die Transaktionshistorie auf Muster von niedrigen Käufen und hohen Verkäufen. Achte auf frühe Einstiege in erfolgreiche Token und rechtzeitige Ausstiege.

- Gewinn- und Verlustrechnungen: Verwende Tools wie Peachfolio oder Zerion, um detaillierte PnL-Berichte zu erhalten. Dies hilft dabei, die Gesamtrentabilität des Wallets zu verstehen.

- Whale-Tracking: Nutze die Whale-Tracking-Funktionen auf Plattformen wie CoinGecko, um die Bewegungen von Großanlegern zu verfolgen, die oft als besser informierte Investoren gelten.

- Preiswarnungen und Benachrichtigungen: Richte auf Plattformen wie Zapper Preiswarnungen ein, um über bedeutende Preisbewegungen informiert zu bleiben, die auf profitable Handelsmöglichkeiten hinweisen könnten.

4. Wichtige Überlegungen

- Sicherheit: Stelle sicher, dass die von Dir genutzten Plattformen keine privaten Schlüssel oder Seed-Phrasen verlangen. Die meisten Tracking-Tools benötigen nur die öffentliche Wallet-Adresse.

- Datenschutz: Wähle Plattformen, die Deinen Datenschutz respektieren und keine persönlichen Informationen verfolgen.

- Benutzeroberfläche: Wähle Tools mit intuitiven und benutzerfreundlichen Oberflächen, um die Navigation und Analyse zu erleichtern.

FAQs

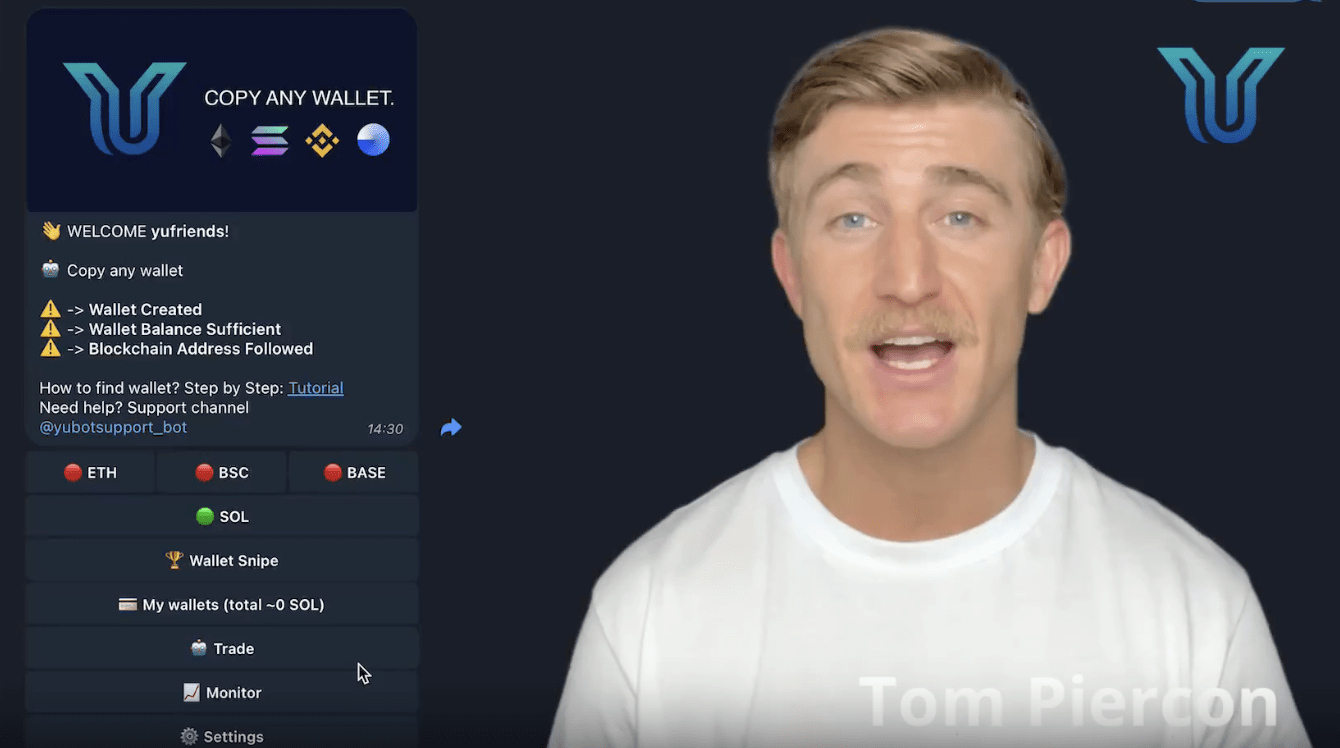

YU BOT is an advanced decentralized finance bot designed to automate trading through copying other addresses. It aims to help users optimize their strategies and maximize returns.

- Telegram Link: Visit the official YU BOT website and press on the link provided

- Create Wallet/ Connect Wallet: Connect your DeFi wallet to YU BOT using a secure, non-custodial connection.

- Deposit Funds: Depending on which Blockchain you use your wallet has to be filled with enough funds to execute operations

- Configure Settings: Customize your bot’s settings and strategies to suit your preferences.

- Choose Address: In order to use the software you have to copy a blockchain address.

- Activate YU BOT: Start the bot and monitor its performance through the user dashboard.

YU BOT includes several risk management features such as:

- Stop-Loss Orders: Automatically sell assets when they reach a predefined loss threshold.

- Take-Profit Orders: Lock in profits by exiting positions at specified target levels.

- Diversification Tools: Spread investments across multiple assets and platforms to minimize risk.

- LOT Size: You can choose the Size of how much you want to risk per transaction.

We do NOT have access to your private keys. YU BOT prioritizes user security by employing AES256 encryption, one of the most robust encryption standards available. This ensures that any data exchanged between users and our bot remains confidential and protected from potential breaches.

That said, DO NOT transfer more funds to YU BOT than you can afford to lose. We advise users to treat YU BOT as a hot wallet: transfer only the amount you need for trading, and transfer back to your main wallet once your trading is complete.

You can contact YU BOT customer support via email at support@yu.app or through our support portal. We aim to respond to all inquiries within 24-48 hours.